2 Floor Limitation Miscellaneous Deductions

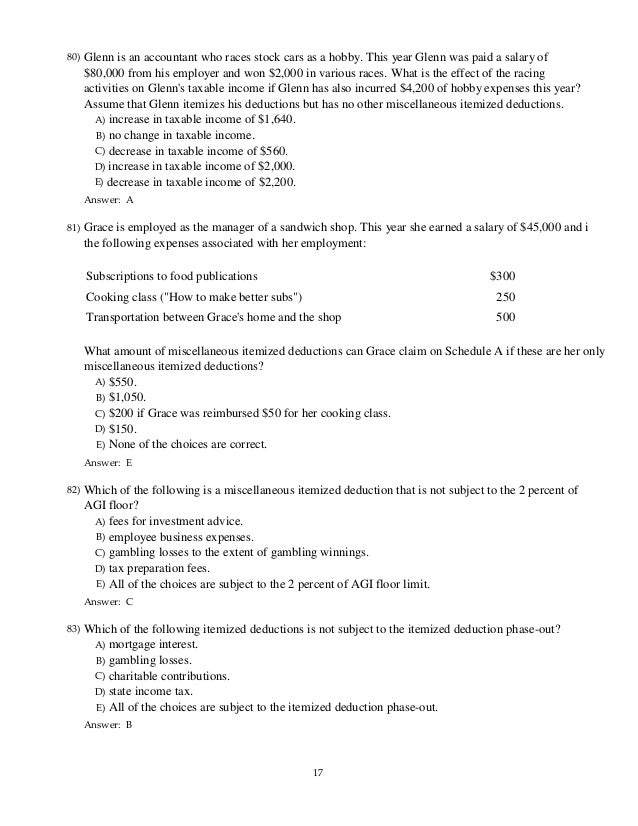

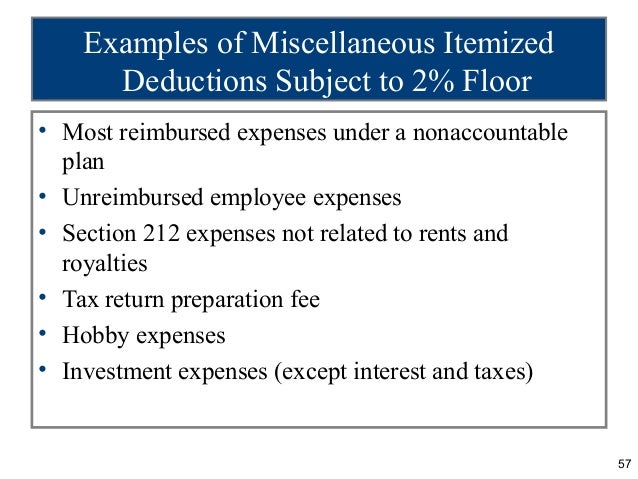

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

2 floor limitation miscellaneous deductions. The 2 rule referred to the limitation on certain miscellaneous itemized deductions which included things like unreimbursed job expenses tax prep investment advisory fees and safe deposit box rentals. The regulations will apply to tax years beginning on or after may 9 2014. This publication covers the following topics. Miscellaneous deductions are deductions that do not fit into other categories of the tax code.

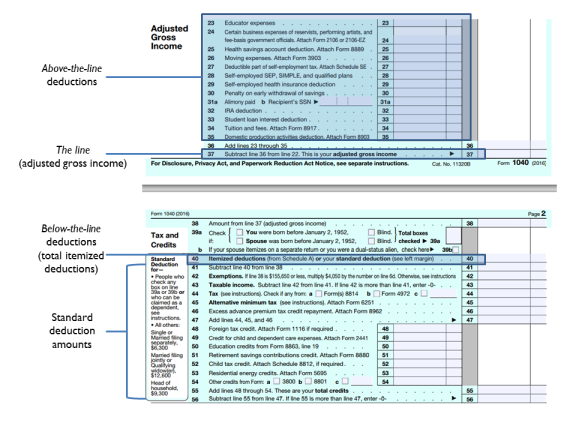

Starting on january 1 2018 and running through december 31 2026 individuals will no longer have the ability to deduct the excess expenses listed below as itemized deductions on their 1040s. 2 percent floor on miscellaneous itemized deductions. There are two types of miscellaneous deductions. Deductible expenses subject to the 2 floor includes.

2 percent floor on miscellaneous itemized deductions. Expenses for uniforms and special clothing. Except as otherwise provided in paragraph d of this section to the extent that any limitation or restriction is placed on the amount of a miscellaneous itemized deduction that limitation shall apply prior to the application of the 2 percent floor. Miscellaneous itemized deductions subject to the 2 floor aren t deductible for tax years 2018 through 2025.

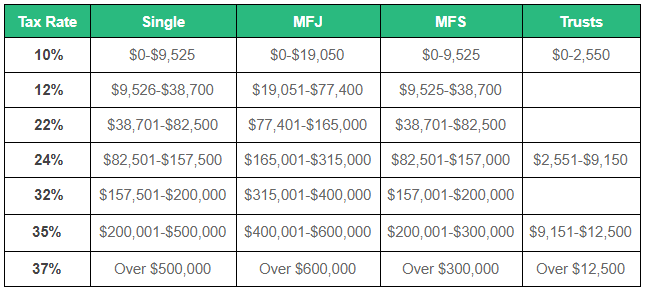

As of the 2018 tax year itemized deductions for job related expenses or other miscellaneous expenses outlined below that exceeded 2 of your income have been suspended. These losses are not subject to the 2 limit on miscellaneous itemized deductions. Unreimbursed employee business expenses such as. The irs issued final regulations on the controversial question of which costs incurred by trusts and estates are subject to the 2 floor on miscellaneous deductions under sec.

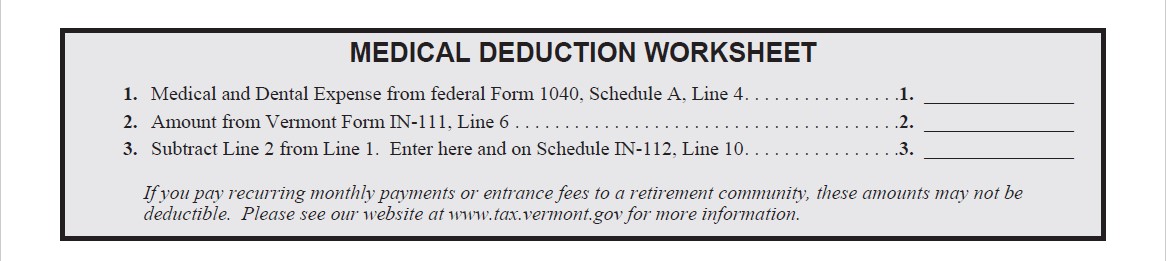

For example in the case of an expense for food or beverages only 80 percent of which is allowable as a deduction. This section shall be applied before the application of the dollar limitation of the second sentence of section 162 a relating to trade or business expenses. 1 deductions subject to the 2 limit these deductions allow you to deduct only the amount of expense that is over 2 of your adjusted gross income or agi. However deductions under section 67 e 1 continue to be deductible if they are costs that are incurred in connection with the administration of an estate or a non grantor trust that would not have been incurred if the property were.

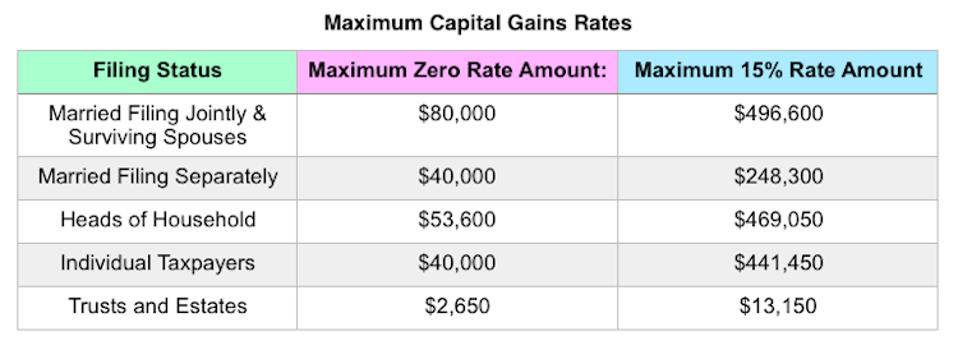

However the deduction is limited to the amount of taxable. For tax years previous to 2018 if you itemize your deductions part of the expenses that you claim as deductions may be limited by the 2 rule deductions that are included are unreimbursed employee expenses expenses. Investment interest remains deductible for taxpayers who itemize.

/taxes-5bfc47be46e0fb0026623559.jpg)

/GettyImages-185121670-3e5dcbc98b0a4409914ea75fbe557091.jpg)